Enjoy easy online access to your accounts with OnLine AnyTime. Your accounts are easier to manage than ever. Whether you are checking a balance, transferring to savings or setting up a series of payments, our OnLine AnyTime has you covered.

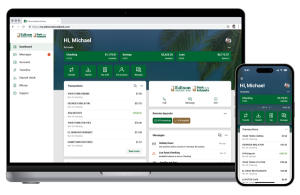

Online & Mobile Banking

To bank anywhere and everywhere download the Edison National Bank Mobile Banking free mobile app for your device and log in with your OnLine AnyTime User ID and password. If you’re not an OnLine AnyTime banking user, please visit one of our conveniently located offices to enroll.

Enjoy easy online access to your accounts with OnLine AnyTime. Your accounts are easier to manage than ever. Whether you are checking a balance, transferring to savings or setting up a series of payments, our OnLine AnyTime has you covered.

Banking anytime, anywhere! Mobile banking is easier and more convenient than ever by using your Apple or Android mobile device.

Mobile Banking allows you to transact your banking business anytime, from anywhere. Customers can view account balances and transactions, initiate account transfers, make deposits and pay bills.

Mobile Banking provides access to the following:

Make Deposits anytime, anywhere! Deposit checks directly from your Apple or Android mobile device simply by taking a picture from your tablet or phone’s camera.

Consumer Bill Pay gives you the ability to manage and pay your bills all in one place.

Manage back-office duties more effectively and run your business more efficiently. Pay multiple invoices at once, approve transactions, set up recurring payments, track spending and more.

Business Bill Pay Demo

We are proud to introduce the Card Management feature which gives you the power to make the rules of how, when, where – and WHO uses your cards.

Card Management is an easy-to-use feature located within your Mobile Banking App and OnLine AnyTime desktop that lets you set controls, add restrictions, receive customized alerts about your card, and more. This secure and highly-encrypted app adds another layer of fraud protection and prevention, and gives you added peace of mind.

Simply login to your Mobile Banking App or OnLine AnyTime desktop. If you have not yet enrolled in OnLine AnyTime, please call us at (239) 466-1800.

Scroll down the Dashboard until you see the Card Management tile. Select a debit card and then select how you want to control your debit card:

From this screen you can:

*Message and Data Rates May Apply.

Note: Our previous service for debit card text alerts, MyCardRules has been discontinued. Please follow instructions above to continue receiving security alerts for your Edison National Bank debit card transactions